Did you know the New Zealand government matches every dollar you contribute to Kiwisaver with 50cents? The maximum that can be given as a topup is $521.43. This will be reflected as Member Tax Credits. With simple math, you need to have contributed atleast $1,042.86 for one year from July 1 to be eligible for the maximum topup. Otherwise, you’ll get the corresponding 50 cents pro-rata. If in case you need to topup, voluntary contribution must be deposited to your scheme provider on or before the deadline. Contact your provider. Normally that’s around last week of June.

STEPS IN DETERMINING THE TOTAL CONTRIBUTION NEEDED

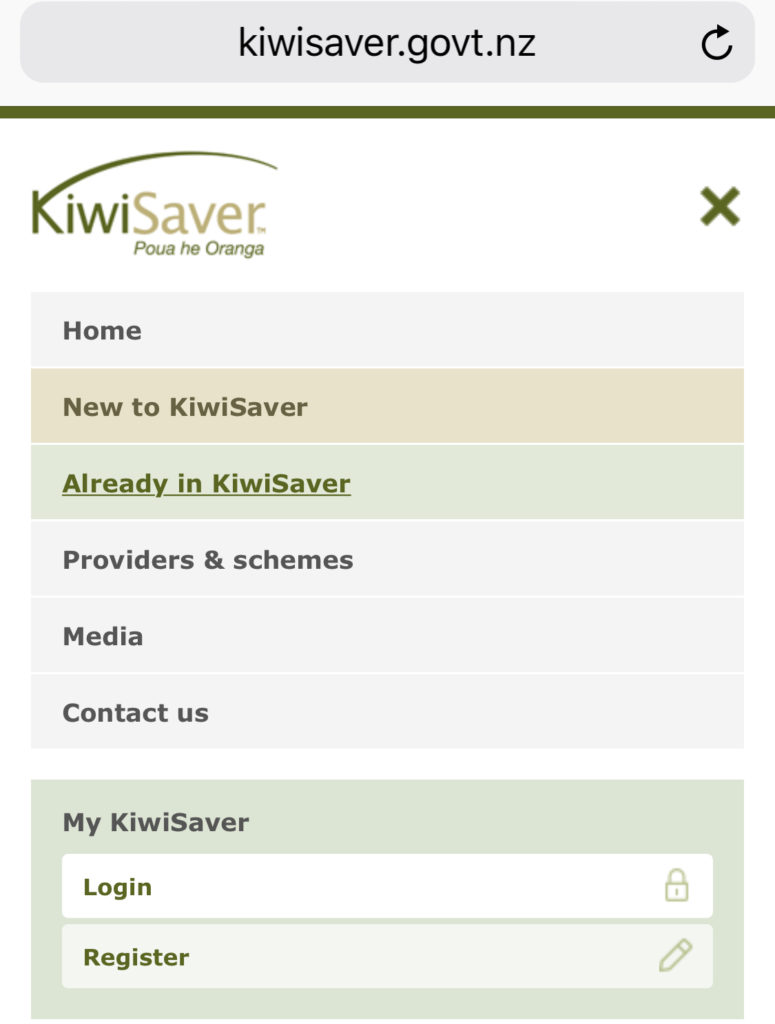

- Login to Kiwisaver. It will divert you to the myIR as they are linked.

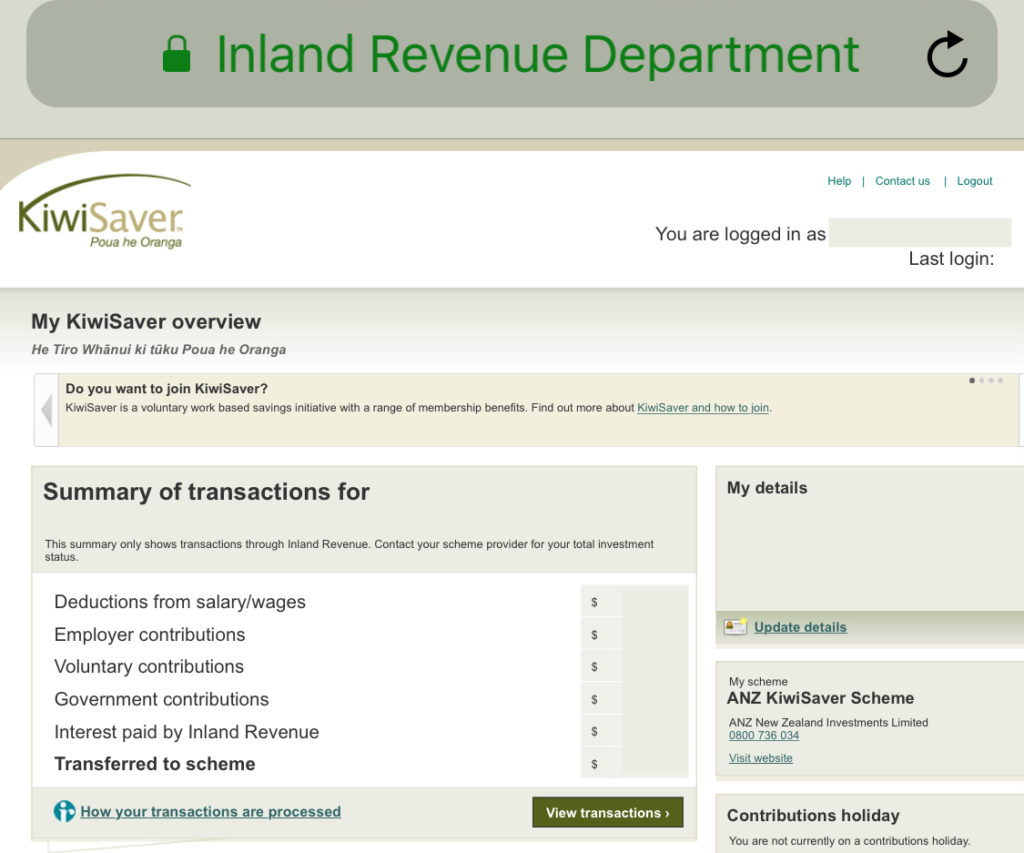

2. Click View transactions.

3. Show Deductions from salary/wages. Filter the date from July 1 on the previous year up to present. Get the total value under Transferred to scheme.

4. Remaining Contribution to reach the maximum government grant = $1,042.86 – Transfer to scheme. The result will be the voluntary contribution that you need to pay to reach the maximum grant.

Visit https://www.ird.govt.nz/kiwisaver for more information.

But wait, read below for additional perk.

$1,180 Minimum Kiwisaver Contribution per Year for First Home Buyer to be Eligible

This will be applicable to eligible first home buyers. KiwiSaver contribution requirements for Home Start Grant taken from its website are shown below.

You must have been regularly contributing at least the minimum amount to KiwiSaver for 3 years.

- The minimum contribution is currently 3% of your total income.

- The 3 years don’t have to be consecutive, as long as they add up to 3 years’ worth of contributions. For example, if you have been a KiwiSaver member for 3 years but took a 6 month savings suspension, you would not be eligible for the First Home Grant until you had contributed for another 6 months.

- Contributions must be made from all your sources of income, not just your main source of income.

- If you are a non-earner you need to make voluntary contributions of at least 3% of the adult minimum wage based on a 40 hour week.

- If you are self-employed or on a benefit and make voluntary contributions, you need to have made contributions at least once a year for 3 years of at least 3% of your annual income.

- If you have made a combination of automatic and voluntary contributions, the total amount needs to be at least 3% of your total annual income.

Take note of bullet in bold characters. Minimum contribution for non-earners to be eligible for Home Start Grant.

The adult minimum wage has increased by $1.20 from $17.70 to $18.90 per hour on 1 April 2020. So to come up with the voluntary contribution for eligibility, below is the calculation.

Minimum Contribution = $18.90 x 40 x 52 x 3% = $1,179.36

The $1,042.86 is required to get the maximum Government Grant Kiwisaver topup of $521.43. But to be eligible with the HomeStart Grant, a minimum contribution of $1,179.36 is required. That’s additional $136.50 more voluntary contribution. This is hitting two birds with one stone. With the said amount you will get the $521.43 plus eligibility count for 1 year of HomeStart Grant.

Summary

- Minimim Kiwisaver topup of $1,042.86 to be eligible for Government Grant of $521.43

- Minimim Kiwisaver topup of $1,179.36 to be eligible for Government Grant of $521.43 and HomeStart Grant.

- Contact your Kiwisaver scheme provider, IRD and the Kāinga Ora – Homes and Communities for detailed info.

Disclaimer : All posts are reflection of the author’s ideas and do not represent anyone else. Author(s) are not financial adviser(s), simply a passive investor. Please consult a registered financial adviser for a personalised advice.